Hi everyone, I newly started a blog concentrated on Turkish economy, which you can find bright investment ideas and unique stock tips. Additionally, I will be posting about mergers & acquisitions activities in Turkey, things going around Turkish business environment as well as sharing some eye-opening opinions of mine on Turkey's macroeconomic outlook and expectations. Do not even forget to visit it by typing turkishmarketnews.com to your address bar. I hope you'll enjoy it and feedback well.

Oguz Erkol's Personal Blog

October 30, 2013

TurkishMarketNews.Com is on-the-air

Hi everyone, I newly started a blog concentrated on Turkish economy, which you can find bright investment ideas and unique stock tips. Additionally, I will be posting about mergers & acquisitions activities in Turkey, things going around Turkish business environment as well as sharing some eye-opening opinions of mine on Turkey's macroeconomic outlook and expectations. Do not even forget to visit it by typing turkishmarketnews.com to your address bar. I hope you'll enjoy it and feedback well.

April 10, 2012

On Emerging Countries

Recently, my new article on emerging countries was published on Seeking Alpha. I shared my expectations on China, India, Brazil, Russia, South Africa, Turkey, and Mexico, respectively and made some forecast in point of view of growth, inflation and other macroeconomic indicators. In brief, Brazil is the country, which I think is a good buy, while South Africa unlikely to meets the expectations, in my opinion.

You can read the whole article here

March 22, 2012

Will Turkey Say Goodbye To "10s Club" This Year?

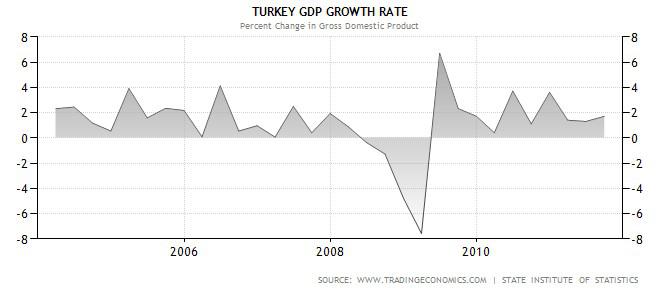

2011 has been an extraordinary year for Turkish economy. As of third quarter, it was the second fastest growing country after China. Well, it all sounds broad brush strokes, because, in fact, 2011 has been too good for country. Yet it led country to get a well-deserved membership of "the 10s club" which I will give more details about below to make myself clear.

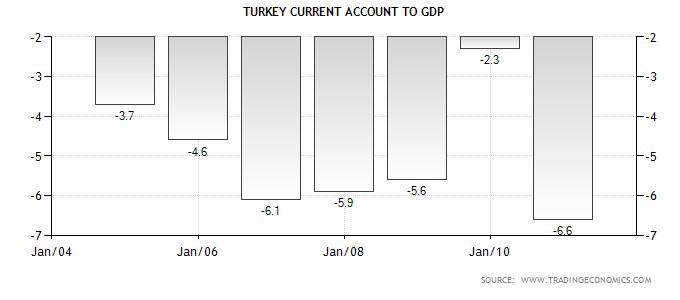

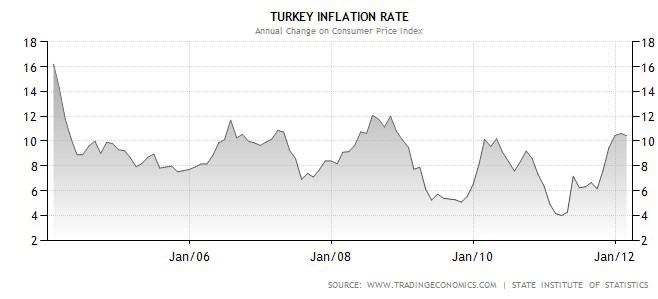

Turkey's Consumer Price Index, current account deficit to GDP and real GDP growth rate were all double digits in 2011 and that is why country is a member of the "10s club." It has been heatedly argued whether economy is overheating or not. Well, to be honest, with these CPI and CAD rates, a growth rate over 10% is not sustainable. This also gives us some opinion about whether the economy is a bubble or bust.

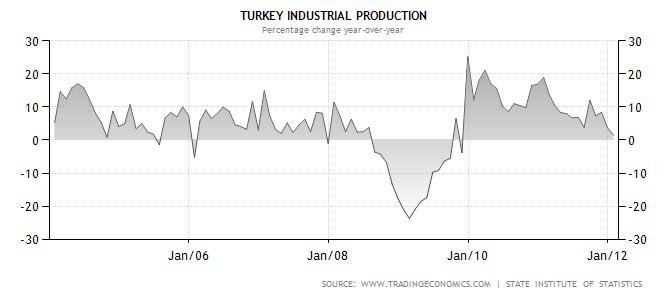

So how is 2012 so far? The incoming industrial production data announced by TurkStat shows that industrial production index grew by 1.5% in January year-over-year much lower than expected(seasonally adjusted growth rate on industrial production is -3.1%), but supporting the soft-landing scenario as well as is a result of tightening policy being ran by Central Bank of Turkey as of last October. Considering Turkey's Purchasing Managers' Index, that dropped below 50 for the first time since last August, indicates a controlled and anticipated contraction in the economy.

Is there any risks to break this fine soft-landing trend line? The answer is yes, of course. Furthermore, the economy is on a thin line, because both upside and downside risks still remain.

Is there any risks to break this fine soft-landing trend line? The answer is yes, of course. Furthermore, the economy is on a thin line, because both upside and downside risks still remain.

Let me start with the "upside" risks. As I mentioned above, Turkish economy has had clear signs to rise overheating fears as economy has boomed through 2011 and because of this, normally all politicians in developed economies are seeking for satisfying growth rates, on the contrary Turkish economy may suffer thanks to a high growth rate. Because in current economic model in Turkey, growth comes with inflation and current account deficit. Owing to the recovery perception in global markets, Turkish economy has a nonignorable upside risk.

Another risk for Turkish economy is increasing oil prices. Turkey is an oil importing country and that is the main reason of its high CAD. Another 20% rise in oil prices will cause 12-month headline numbers to worsen, such as CAD and CPI. Another risky point is that the base effects from the last year will make these numbers look worse than they actually are especially during the first quarter.

Negative influences of Euro Area sovereign debt crisis on capital flows, increasing oil prices that marks the CAD up, results of CBT's unpredictable monetary policies still constitute crucial risks for country but lessons learned at the 2001's huge financial crisis were vitally beneficial for country that helped it to face the challenge of 2009's global recession as they might do the same thing on the next downfall.

Subscribe to:

Posts (Atom)